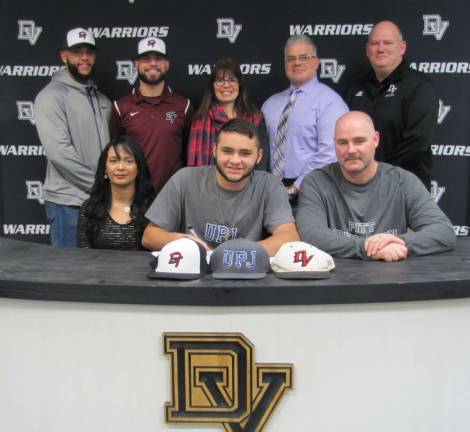

Baseball player Raymond Kruse signs with University of Pittsburgh

| 11 Dec 2018 | 03:50

Delaware Valley High School senior baseball player Raymond Kruse has signed with the University of Pittsburgh at Johnstown-Division II. He plans on majoring in electrical engineering. He's the son of Raymond and Glenda Kruse of Milford. Pictured in the front row (from left): Mrs. Glenda Kruse, senior Raymond Kruse and Mr. Raymond Kruse; back row: Joel Castillo (Downtown Baseball Academy coach), Mark Strouse (Downtown Baseball Academy coach), guidance counselor Molly Blaut, head baseball coach Dave Peters, and athletic director Chris Ross. (Photo provided)